Software for liquidity management

Optimum use of financial resources with liquidity planning software.

Real-time overview of cash flows and accounts

Financial resources determine the operational possibilities, strategic planning and ultimately the success of your company. It is therefore crucial to maintain control and an overview of these resources. This is exactly where liquidity planning software comes into play.

With Corporate Planner Cash, you always have a real-time overview of your company's cash flows and accounts. Thanks to the software's innovative functions, you receive up-to-date information about your payment flows on a daily basis. This real-time data can help you make more efficient decisions and make the best use of your company's financial resources.

Proactive management of liquidity bottlenecks

But what happens if a liquidity bottleneck becomes apparent? We also have a solution for this. Corporate Planner Cash continuously analyzes your finances and can identify potential liquidity bottlenecks at an early stage. You will then receive customized suggestions for money transfers to bridge these shortages. In this way, you can avoid financial surprises and ensure your liquidity.

Optimization of surplus investments

It is also important to know when and where you should invest your surplus funds in order to achieve the best interest rate. Corporate Planner Cash not only recognizes cash surpluses, but also shows you which accounts you can invest in at the best interest rate. In this way, you can ensure that your surplus funds are used efficiently and profitably.

Security and success through effective liquidity planning.

With all these functions and options, the liquidity planning software allows you to keep control of your finances and make the best possible use of them.

Corporate Planner Cash is an essential tool for optimizing your company's liquidity planning and ensuring your financial success. After all, liquidity planning is not just about figures, but about making well-founded decisions that influence the well-being and progress of your company.

Vollständige Kontrolle mit Cash Pooling.

Central cash flow management through cash pooling

Cash pooling is a cash management method that enables companies to manage their financial resources efficiently. Cash pooling enables your company to centralize the funds of the various accounts and company units. This gives your company a clear overview of the overall financial situation and enables optimized cash flow planning.

Proactive cash management and cash flow hedging

Thanks to the real-time overview of all accounts and cash flows, bottlenecks can be identified at an early stage and your company can be informed proactively. This enables your company to take measures in good time and avoid potential liquidity bottlenecks. In addition, cash pooling offers the opportunity to optimize surplus investments and thus improve your company's cash flow.

Seamless integration into day-to-day business

Liquidity planning software can be easily and seamlessly integrated into everyday business life. Thanks to a wide range of integrations, the tool can be easily incorporated into existing systems. Automatic data entry and the use of real-time data ensure a smooth process and a reliable liquidity plan.

Forecasts and scenarios for effective financial decisions.

Liquidity management is a crucial aspect of a company's financial well-being. With Corporate Planner for liquidity management, companies can create accurate forecasts and scenarios to help them make effective financial decisions. With the help of real-time data, you can ensure that your liquidity forecasts are always up to date and that you create your liquidity forecast on the basis of current data. This enables more precise and reliable liquidity planning

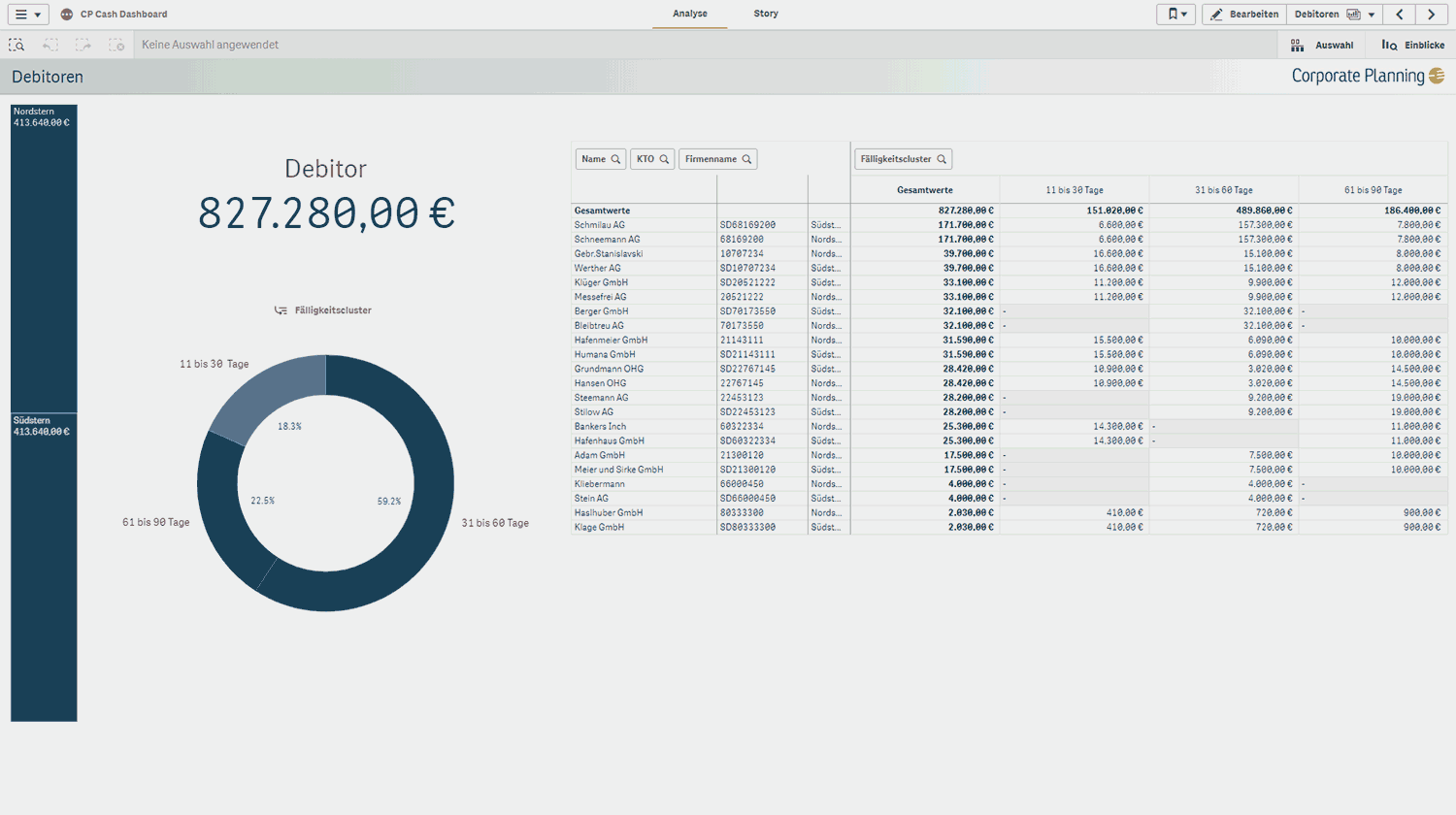

Proactive reduction of bad debts.

Corporate Planner Cash is a liquidity management tool that is designed to help you proactively reduce bad debts. By closely monitoring the payment behavior of your debtors, you can identify payment delays and defaults at an early stage and take appropriate measures. This not only improves your liquidity, but also increases the security of your liquidity planning.

Forecasts and scenarios for effective financial decisions.

Liquidity management is a crucial aspect of a company's financial well-being. With Corporate Planner for liquidity management, companies can create accurate forecasts and scenarios to help them make effective financial decisions. With the help of real-time data, you can ensure that your liquidity forecasts are always up to date and that you create your liquidity forecast on the basis of current data. This enables more precise and reliable liquidity planning